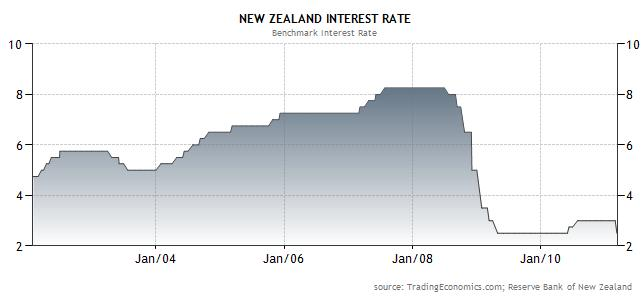

There are two principal reasons for the Kiwi’s perennial appeal with forex traders. First, New Zealand frequently boasts some of the highest interest rates in the industrialized world. Before the credit bubble burst, New Zealand’s benchmark interest rate was a whopping 8.25%. Moreover, because of its association with Australia, investors are quick to ascribe to it (dubiously) a greater sense of security than they would to emerging market economies with similarly high interest rates. For example, while Brazilian rates are usually higher, the markets less apt to lump the Real together with the Australian Dollar, even though it’s arguably a closer fit than the Kiwi.

While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher.

While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher.The credit crisis should have shattered the myth of the NZD as a stable currency, since the NZD lost 50% of its value in a matter of months. In addition, the benchmark rate has been lowered to 2.5%, a record low. When you take inflation into account, the rate is -2%, which as far as I know, is among the lowest in the world. When you factor in consecutive budget deficits for the first time in two decades and the (unrelated) explosion in public debt, it baffles me that yield seekers would still be interested in holding the Kiwi.

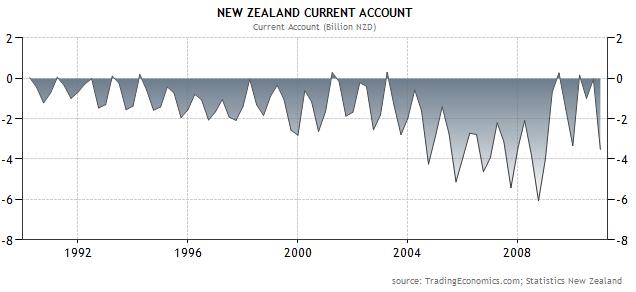

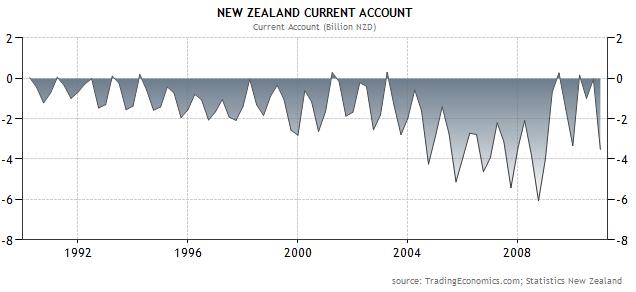

The other source of strength is the perception that the Kiwi is a commodity currency. To be fair, the production and export of agricultural products (dairy, meat, wool, etc.) makes a significant contribution to New Zealand’s economy. In addition, the prices for such agricultural staples have been rising faster than prices for imported goods, to the extent that the terms of trade have widened further in New Zealand’s favor. Unfortunately, this is ultimately irrelevant, since the aggregate balance of trade is currently in deficit, where it has stood for most of the last decade. If prices for energy and traditional commodities continues to rise, the current account deficit would at risk for eclipsing the record 6% set in 2008.

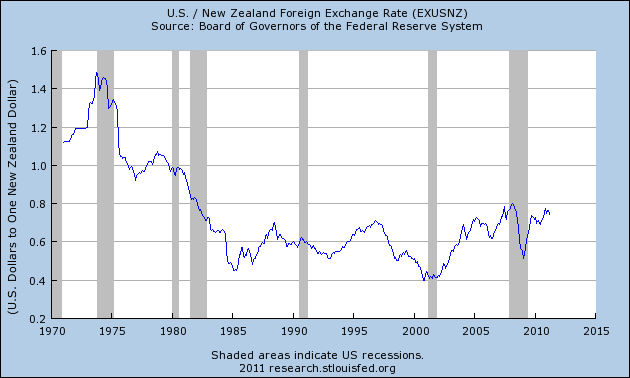

With all of this in mind, it’s tough to understand how the New Zealand Dollar could be closing in on a post-float (30 year) high against the Dollar, last set in 2008. The New Zealand Dollar has recovered most of its post-credit crisis losses, despite a lack of fundamental support. Its recovery has even outpaced the rise in the New Zealand stock market. In short, I’m inclined to agree with TD Securities: ” ‘If ever there was a dangerous time to enter a NZD carry trade this is it: the NZD is increasingly stretched, with the risk-reward now squarely being the NZD declining from here’…if the NZD breaches prior record highs, ‘it could be an attractive time to trim some net longs.’ ”

The other source of strength is the perception that the Kiwi is a commodity currency. To be fair, the production and export of agricultural products (dairy, meat, wool, etc.) makes a significant contribution to New Zealand’s economy. In addition, the prices for such agricultural staples have been rising faster than prices for imported goods, to the extent that the terms of trade have widened further in New Zealand’s favor. Unfortunately, this is ultimately irrelevant, since the aggregate balance of trade is currently in deficit, where it has stood for most of the last decade. If prices for energy and traditional commodities continues to rise, the current account deficit would at risk for eclipsing the record 6% set in 2008.